By Toynbee Hall and Building Societies Association

Politics Home 23 September 2019

A new report from Toynbee Hall, supported by the Building Societies Association has disproved the idea that people on lower incomes don’t save.

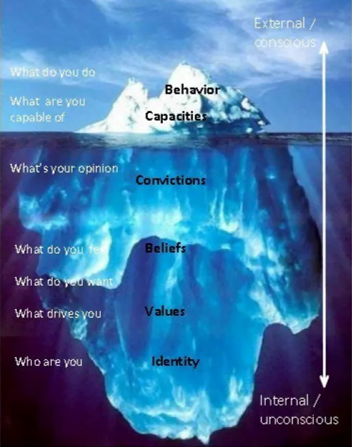

People’s attitudes and behaviours are the most important factors in predicting their savings – rather than age and income level. After adjusting for level of income the figures show people with higher incomes don’t save a higher percentage of their income.

The report says that people usually save for two or more reasons, often either linked or competing for spare cash. It also says surprisingly that “a large number of people (67%) surveyed are in a position to start saving – or increase their saving by a very small amount.”

The report builds on Saving for the Future, which identified six different types of saver; the Spend Saver, the Reward Treat Saver, the Safety Net Saver, the Life Goal Saver, the Savings Goal Saver and the Passive Saver. Each of these has a different motivation and purpose for their savings, which should be recognised when encouraging people to save.

On average, those in this age group who do save have £1,600 in the bank – up from £900 a decade ago.

However, a savings gap has also emerged with the top 10% of savers having £15,000 or more set aside, according to the latest figures from 2014 to 2016, compared with the bottom 10% who had less than £100.

Home ownership has also fallen since the financial crisis, with the proportion of 22 to 29-year-olds with their own property falling by 10 percentage points between 2008 and 2017, according to the ONS.

As a result, more were living at home or renting, primarily from private landlords, since the financial crisis.

However, only 37% of this age group were in debt (not including student loans) compared with 49% a decade ago.

Those with debts owe an average of £1,900 – some £100 more than the typical debt 10 years earlier.

The 10% most indebted owed at least £14,200, the latest data shows. See DebtDrive for more on debt.