Your Dashboard Tools

it's 18 Jan, 2025 6:50 pm

Great financial planning

field_5f0c304c72876 - is the title of the exercise

Exercise Summary

The following was written by Caroline Bloor an published on goodhousekeeping.com

How to create a financial plan

We’re all keen to see the back of 2020 – no explanations needed. As much as anything else, it’s been a year of financial changes and challenges. For the lucky, there has been extra money in the bank (through money saved working from home) but for others in sectors most affected by the pandemic, monthly incomes have been squeezed or have evaporated completely.

So how can you best prepare for 2021 and ensure your finances are in the best possible place to help you tackle whatever comes your way? The answer? Create a financial plan summing up your current money situation, your long-term monetary goals, and, most importantly, how you intend to achieve them. Make it with the long term in mind.

Main Activity

Study, educate and create an action plan of activity

The following was written by Caroline Bloor an published on goodhousekeeping.com

8 steps to create a financial plan

In a time when we all crave certainty a financial plan is one way of helping you smooth out the bumps and face the year more positively. Here we’ve set out a checklist to help you create a financial plan of your own.

1. Know your money flow

You may have spent a lot of time in 2020 rationalising bills, cancelling unused direct debits and subscriptions, or finding better deals to switch to for everything from utilities to bank accounts. You may even have found spare cash to squirrel away through reduced travel and leisure costs. Time to familiarise yourself properly with these changed habits – what’s coming in and what’s going out.

Know what you spend. If you need a kick-start, do this: make a list of all your regular monthly outgoings (use your bank statements) in three columns: needs, wants, savings. ‘Needs’ should have your utilities, groceries, essential travel costs, insurances. ‘Wants’ will be for non-essential spending like shopping, leisure activities, entertainment. ‘Savings’ speaks for itself (but don’t forget to include pension contributions made outside your monthly pay cheque).

Total up your income. This isn’t just salary, it could be money from interest on savings, cash gifts, child benefit, carer’s allowance, any property rental income, any regular money made from selling things online, etc. Subtract your monthly expenses from your income to see whether you have a shortfall or money left over. If you are spending more than you have coming in, then see where you can make cuts.

2. Set yourself a monthly budget

Now you’ve got a clearer picture of exactly what’s coming in and going out of the bank every month, create a budget to help you address any imbalance. As well as looking month to month, think about the year ahead and any spending surges or income dips that you will have to ride. Plan for these too. If you need help making a monthly or annual budget plan, use the budget calculator from the Money Advice Service.

“I’m a fan of the 50/30/20 flexible approach: 50% of your take-home pay goes to your needs (bills, food, minimum debt payments); 30% goes to Future You (debt payments above the minimums, saving for emergencies and investing),” says Emma Stevens from Corinthian Wealth Management. “Save first, spend late -if you do this, it’s a sure way towards financial freedom.”

If you find it hard to keep track of your incomings and outgoings, ask your bank what help they can offer – online banking or using your banking app makes it much easier to see at a glance what you have spent month to month and in what categories.

“If you do not want to open another bank account, then take a look at Yolt. It’s a free budgeting app that links all your bank accounts and credit cards and then shows you on a handy dashboard what’s coming in and out. Next month, it is also launching a spending account, which will help you save as you spend with cashback and a round-up of loose change.”

3. Make a debt strategy

You may have credit or store cards that have been maxed out over Christmas, you may have a personal loan or have used Buy Now Pay Later schemes when you shop. If you are paying interest on any debt, this is money down the drain. It’s time to make a strategy for how you can be debt-free this year (we’re not talking about mortgages, that’s another issue we’ll come to).

*Use savings to pay off debts. This is more important, as things stand, than topping up your emergency fund. The benefit of getting rid of the growing interest from a credit card (now typically charging 20%) will far outweigh the interest earned on the same money in a savings account (where rates are typically 0.3-0.5%). (But if you are paying off debt at a fixed rate and would be charged a fee to exit this arrangement, you’ll need to be sure the maths still make sense).

*Pay off the most expensive debt first.

*Minimise interest on any debt you can’t pay off.

*For any debt you can’t pay off with savings, move it to a 0% deal such as a balance transfer card or a 0% overdraft bank account. Check out the best buy tables at moneyfacts.co.uk.

*Going forward, list off the debts by most expensive first and prioritise using any savings or spare cash to reduce the debt each month.

*Debt out of control? If you can’t meet the minimum payments on your debt, explain your difficulties to your creditors and get a payment plan in place. “You might also benefit from some budgeting guidance to see if there are any ways you could make your money stretch a bit further. It’s not usually a good idea to borrow more money if you can’t meet your minimum payments,” says Sue Anderson, from debt charity Stepchange.

4. Top up the emergency account

Your emergency fund (or rainy-day fund) may be feeling a little depleted after 2020. After paying off what debt you can, it’s essential to prioritise saving into this account. If you don’t have a separate account, then set one up now. For your emergency fund to be any help to you in difficult times, this should have a minimum of three months’ income in it, preferably six months. If you are starting from scratch, one month’s income should be your short-term goal. Once you’re clear on how much you can afford to save, the easiest way to save is by setting up a direct debit at the start of the month just after your salary has come in.

Zoe Bailey, chartered financial planner and director at Tilney commented: “The future is uncertain for all of us right now, so it’s crucial you take this time to put a plan in place, whilst also accepting that it might need adapting at short notice. Everyone should endeavour to have some ‘rainy day’ cash savings put aside, to provide a financial buffer for emergencies and unusual times like we’ve had this year. While a large savings account can seemingly provide a sense of security, you should have at least 6 months expenditure in cash, above this you should also take this time to check if there is a more efficient plan for some of this cash.”

This content is imported from {embed-name}. You may be able to find the same content in another format, or you may be able to find more information, at their web site.

5. MOT your mortgage

This is one area that you could find yourself able to save a significant amount if you have come to the end of a fixed term on your mortgage.

If you are thinking of remortgaging, find a broker. Use a couple of comparison sites, such as Comparethemarket, including one that includes direct only deals, such as Totallymoney or Moneysavingexpert. Make sure you factor in the cost of the fees. It’s worth making sure your credit score is as good as possible as this will affect how good a proposition you are for any lender.

If you’re having trouble with payments, talk to your lender as soon as possible.

6. Check your retirement pot

One of the most empowering things you can do at the start of the year, is check to see how much you have in retirement savings. It may be more than you think! How can you know if you will have enough to live on once you’ve stopped working, if you don’t set yourself a goal and work towards it? (Ballpark figure, aim to retire on about half your working income).

“Pensions are an important part of your financial picture and it’s important to know how much you’re investing into your pot, where it’s invested and whether it’s enough to ensure a comfortable retirement. Make sure you get hold of the log-in details of your online pension portal and find out,” says Maike Currie, Fidelity International.

Check your state pension, how much it will be and when you are due to receive it HERE.

Check your personal and workplace pensions online or you can ask the HR department if you are unsure how to access this information.

Think how you could boost your pension: it might be by upping your contributions or moving your pension out of the default investment option (where your money is automatically invested when you join the scheme), if it’s not the most suitable for you. For a comfortable retirement, a good rule of thumb is take the age you start your pension and halve it. Then put this % of your pre-tax salary into your pension each year until you retire. (This percentage will include your employer’s contribution too).Talk to your pensions adviser.

Think about consolidating pension pots but always take advice as this isn’t always the right option.“Chances are you’ve had more than one job in your lifetime, which means you have more than one pension pot floating around and will be paying different fees for each of these pots. Never has the saying “don’t put all your eggs in one basket” rang truer than now. Most pensions are usually diversified so your savings are spread across a variety of assets such as shares, cash, property and bonds. Pensions can also be diversified across a range of different locations, so when some asset types or indices decrease in value, others are likely to increase,” says Romi Savova, CEO of PensionBee. “A simple step could be to consolidate your pension pots and pay into one personal plan.”

7. Check your savings and investments are working hard

“If 2021 sees you changing career, taking some time off or starting a family, having a little more set aside will keep you on track,” says Maike Currie. “You’d be surprised how small, but regular payments into a fund or ISA can go almost unnoticed each month but make a big difference over the long run. Set-up a regular savings plan with your ISA provider to make sure you are making the most of ‘drip-feeding’ money into the markets.”

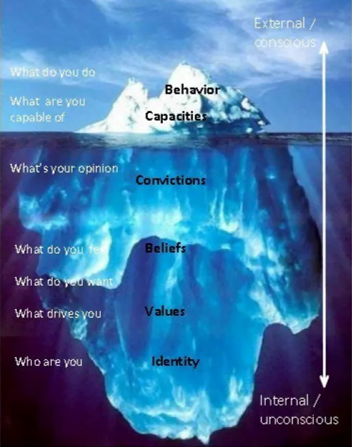

The first step in answering this is to identify your needs and goals. If you need help getting started with this, the Moneyadviceservice has a useful tool ‘complete a money fact find’.

There are lots of factors that will go into deciding where to invest your money – from time frame, tax position, appetite to risk, the kind of returns you need on your money, how much you want to manage your plan yourself. It’s really important to do your research and if you put your money in someone else’s hands ensure they are regulated.

8. Planning for the self-employed/freelance

“After the year that was, it’s never been so vital to financially plan ahead. For anyone who is self-employed, the key focus is to maximise sales and manage costs,” says Emma Jones, founder and CEO of Enterprise Nation. “Achieve this through being in the places and spaces your clients are at (which is highly likely to be online) and trying to secure payment in a timely fashion. This could include agreeing payment plans up front, branching out with a new product with lower price points that attract a bigger market, or indeed going upstream and selling to larger clients through homing in on your niche.”

– Record all activity in a basic excel sheet to keep track of opportunities and produce a cashflow forecast for the year ahead so you can be prepared for any future shocks.

– Try to keep 3 months’ worth of operating costs i.e. the amount it costs to run the business each month in the bank if you ever need to access it.

– Keep a separate account for money reserved to pay your tax bill as you don’t want a shock at year end with a tax bill that can’t be paid.

– Get help with cashflow and money management from qualified and trusted advisers who make the job of staying financially secure so much easier.

Video

Title

Summary

Play

Now you have to decide if you want this exercise to be part of your action plan.

If you don’t, then either hit the back arrow or click the button to go back to look at another exercise.

If you do, then carry on down the page and follow the instructions.

If you want to include this exercise in your action plan, select Yes from on the right then click the green button saying ‘Include this exercise’.

Sadly you’ll go back to the top of this page – please scroll down and fill in the bits that appear before here.

Select the action plan you are working on

See the action plans you have created, and click the button to copy the action plan title in the one you want to associate this exercise with. A box will appear with the name of the action plan shown – click the grey button to the left of it. It will wobble and this will copy the title of the action plan into the clipboard. Then hit the X in the top corner to close that box.

Then click below where it says ‘Paste here’ and right click to paste the action plan title into the box and press the green button.

Test34 action plan called Before yoga

I need to prove how smart I am

LindaB action plan called test action plan

This is a test issue

Linda Contributor action plan called Testing an action plan

Test10 action plan called Testing new action plan

LindaB action plan called Let’s do this!

I feel I am too reserved and quiet and want to become more outgoing and deal with people better

Now you’ve copied the action plan title, paste it on the right and press the green button. After a short pause you will be taken to a page where you will set up your own version of this exercise.

Please bear with us while we set up your own version of this exercise. It will take a short while.

Now you’ve planned your exercise, you will be sent to the page for monitoring how you’re getting on with it.

Press the green button every time you want to add details of when you do the exercise. When you’ve decided how you feel about the exercise, you can fill in the last bits saying how you found it, then press the ‘Update Your Exercise’ button.

Add a comment

You can leave a comment below – we’ll get back to you.